Services for Australia

Bookkeeping & Accounting:

- Day-to-day transaction entry.

- Bank, AP, and AR reconciliations.

- Maintaining accounts in Xero, MYOB, QuickBooks (very popular in Australia).

-

Preparation of monthly management accounts.

BAS / GST Compliance:

- Preparing and filing BAS (Business Activity Statements) with the ATO.

- GST reconciliations.

- PAYG Withholding / PAYG Instalment calculations.

Payroll Processing:

- Salary & wage processing as per Fair Work rules.

- Superannuation contributions compliance.

- Single Touch Payroll (STP) filing with the ATO.

-

Employee leave tracking and payslip generation.

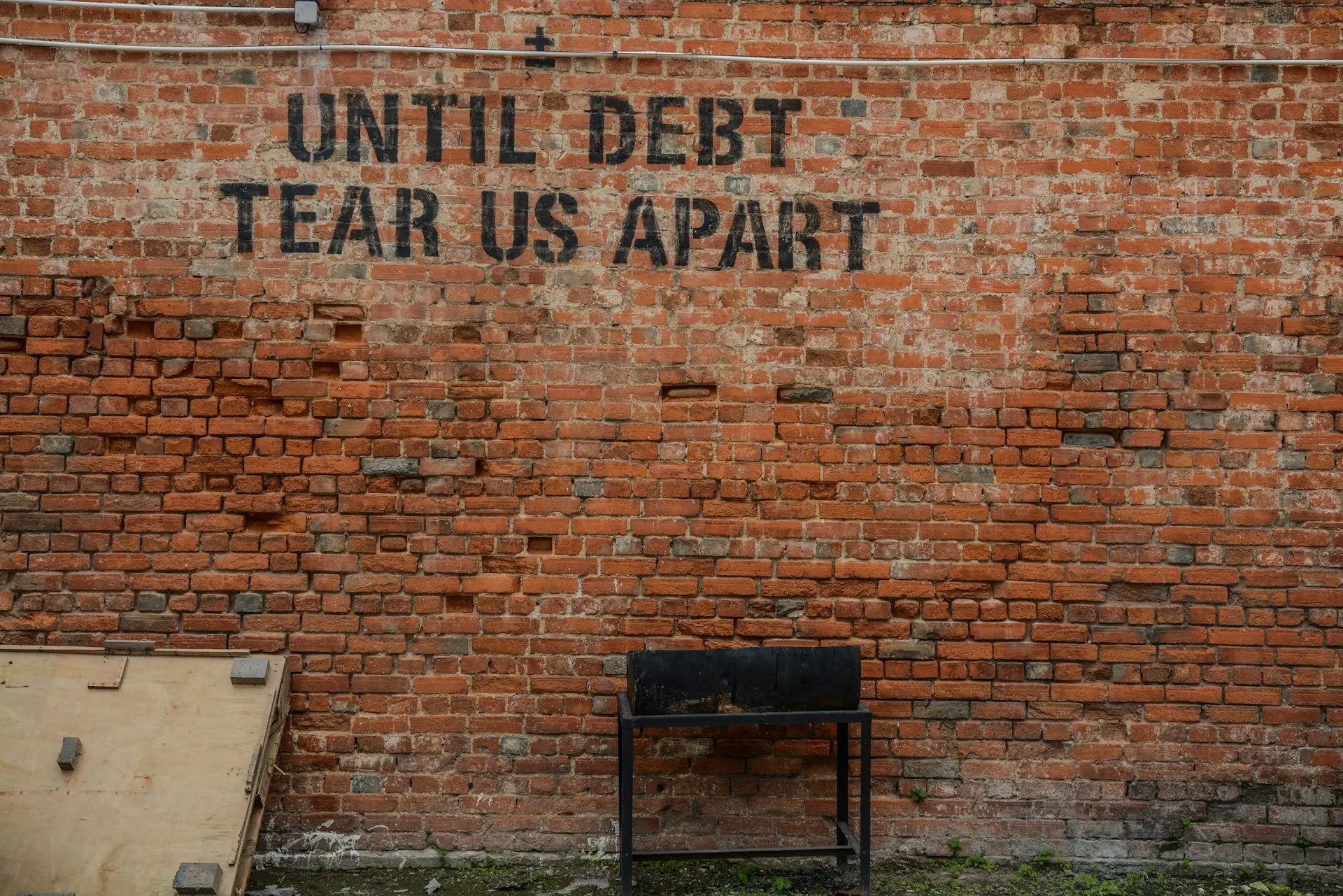

Year-End Compliance & Tax:

- Preparation of year-end financial statements.

- Support in preparing and lodging Company Tax Returns, Partnership Returns, Trust Returns, Individual Tax Returns with the ATO.

- Capital Gains Tax (CGT) calculations.

- Depreciation schedules.

Audit Support:

- Drafting financial statements for statutory audit.

- Preparing working papers (bank, fixed assets, debtor ageing, etc.).

- Supporting local auditors with schedules.

Accounts Payable & Receivable:

- Processing supplier invoices, vendor reconciliations.

- Debtor invoicing & follow-ups.

- Payment run assistance.

SMSF (Self-Managed Superannuation Funds) Accounting:

- Bookkeeping for SMSFs.

- Preparation of annual financial statements & member statements.

- Tax return preparation for SMSFs.

- Audit support for SMSFs.

Virtual CFO & Advisory:

- Cash flow forecasting.

- Budgeting and financial modelling.

- Management reporting dashboards.

Location of our valued clientele

United States of America

New Zealand

Canada

United Kingdom

India